Navigating the EB5 copyright Process: A Step-by-Step Summary of Available Solutions

Navigating with the EB5 copyright process presents a complex landscape for prospective capitalists. Understanding the program's requirements is vital, as is selecting the ideal investment opportunity. Legal aid can make clear paperwork and compliance issues. Each action is important, and ignoring details could threaten the application. Financiers should recognize the subtleties that can affect their chances of success. What approaches can improve their possibility of attaining united state residency through this program?

Recognizing the EB5 Program and Its Demands

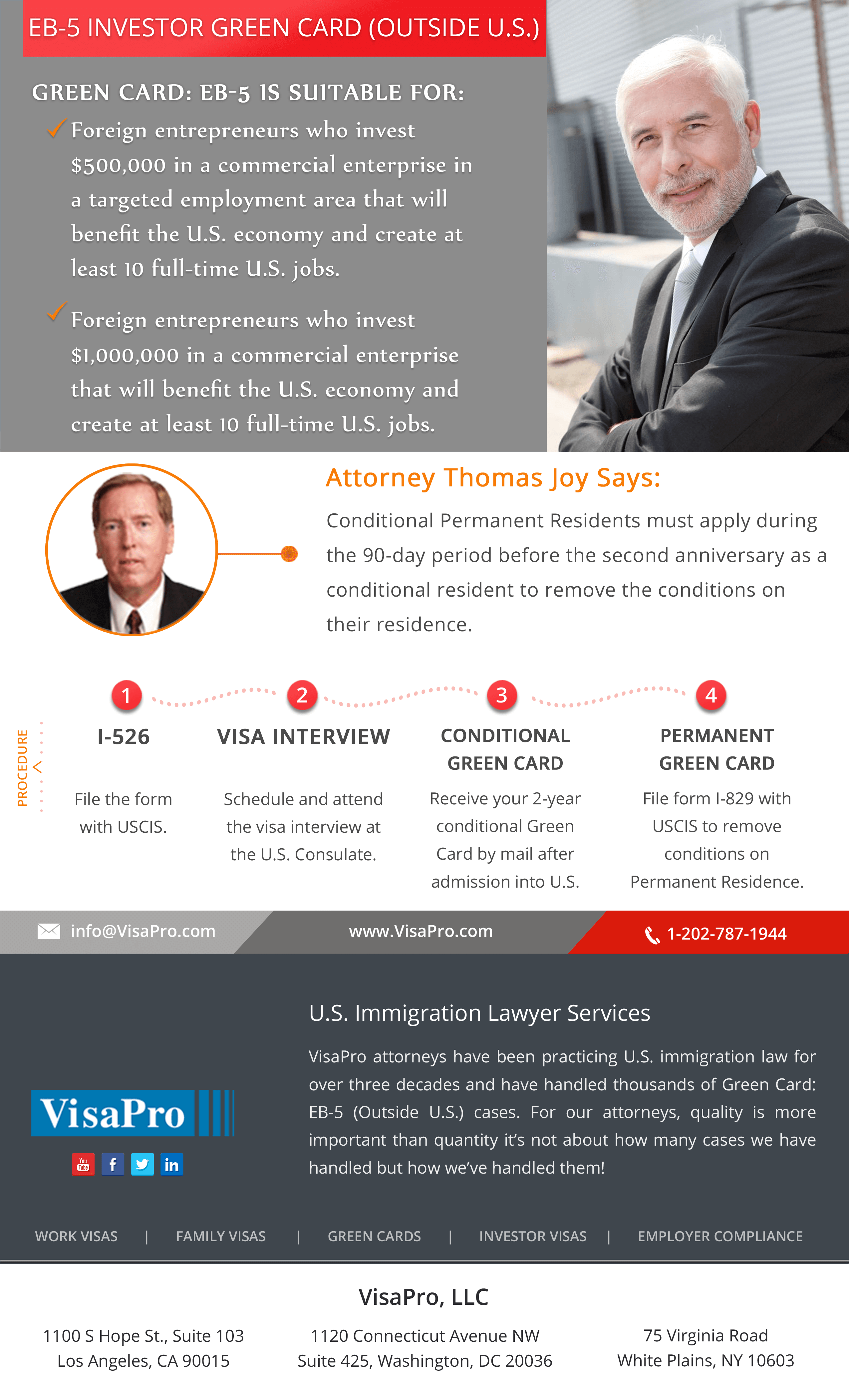

Although the EB5 program has gained appeal among international investors looking for long-term residency in the USA, comprehending its requirements is essential for successful engagement. The program mandates that investors add a minimum of $1 million to a new industrial venture, or $500,000 if purchasing a targeted work area, specified as areas with high unemployment or reduced population density. Furthermore, financiers need to show that their financial investments will create or maintain at least ten permanent jobs for qualifying united state employees within two years of the financial investment. Extensive paperwork is needed to confirm the lawful resource of funds, which adds a layer of complexity to the application process. Applicants must be prepared for extensive history checks and the possibility for meetings with United state Citizenship and Migration Services. Understanding these essential demands is crucial for people aiming to navigate the complexities of the EB5 program efficiently.

Choosing the Right Financial Investment Possibility

Just how can a capitalist warranty they pick the right opportunity within the EB5 program? It begins with comprehensive research study and understanding of the available investment options. Investors should evaluate Regional Centers, which are organizations approved by USCIS, to validate they have a strong record of successful jobs. Examining the economic practicality of the proposed projects is essential, as it impacts both work creation and the roi. Financiers need to also think about the degree of threat connected with each opportunity, as some jobs may be a lot more secure than others.

Consulting with experienced immigration attorneys and monetary consultants can supply beneficial insights into maneuvering these decisions. Furthermore, examining the service strategies and economic projections of prospective investments aids evaluate their expediency. Eventually, a cautious choice process, driven by data and professional recommendations, will assist financiers align their choices with their immigration goals and individual economic passions.

Preparing Your EB5 Application

An effective EB5 application needs careful preparation and attention to detail. Candidates have to initially collect vital paperwork, including proof of the resource of financial investment funds, personal identification, and any pertinent monetary statements. It is crucial to demonstrate that the investment meets the minimum demand of $1 million, or $500,000 in targeted work areas.

Next, applicants need to detail a thorough organization plan, outlining just how the financial investment will certainly develop at the very least ten full time work for U.S. employees. This plan must be realistic and straighten with federal standards.

Furthermore, individuals require to complete Type I-526, the Immigrant Application by Alien Financier, making certain all information is full and exact to avoid delays.

Applicants need to keep duplicates of all sent files for their documents. By complying with these actions, EB5 copyright process individuals can improve their chances of a successful EB5 application.

Lawful Support and Assistance Services

Steering via the complexities of the EB5 copyright process can be frightening, decriminalizing assistance an invaluable resource for possible investors. Legal specialists specializing in immigration legislation deal important advice at every stage of the application. They help ensure that capitalists meet the required demands, consisting of the legitimacy of the investment and adherence to regional facility laws.

These professionals also help in preparing and examining paperwork, decreasing mistakes that could lead to delays or beings rejected. In addition, they can provide insights into the very best investment chances that line up with the candidate's objectives and run the risk of resistance.

Along with application support, lawful help typically encompasses taking care of compliance concerns connected to job production and investment upkeep. By engaging with professional legal advise, financiers can greatly improve their chances of a smooth EB5 procedure, ultimately leading the way for acquiring united state permanent residency.

Navigating the Meeting and Approval Process

While planning for the EB5 interview, financiers have to comprehend the value of this important action in the approval process. This meeting works as a chance for united state Citizenship and Migration Services (USCIS) authorities to validate the authenticity of the financial investment and the capitalist's eligibility. EB5 copyright process. Financiers should anticipate inquiries regarding their resource of funds, task information, and job production plans

Extensive preparation is crucial; this includes gathering needed paperwork and practicing actions to prospective inquiries. Engaging with seasoned immigration lawyers can supply important understandings and assistance throughout this procedure.

Post-interview, USCIS will review the application based on the details provided - EB5 copyright process. Authorization times can vary, yet comprehending the possible timelines and preserving open interaction with legal reps can reduce unpredictability. Successfully navigating this stage eventually rests on precise prep work and an honest presentation of realities, which are important for achieving the preferred end result of obtaining an EB5 copyright

Frequently Asked Questions

The length of time Does the EB5 Application Process Generally Take?

The EB5 application process generally takes between 18 to 24 months. Elements such as regional center involvement, application completeness, and united state Citizenship and Migration Providers handling times can affect the general duration considerably.

Can I Request EB5 While Living Outside the united state?

Yes, people can look for the EB5 program while living outside the U.S. They should follow specific procedures and send needed paperwork from their home country, ultimately looking for united EB5 copyright process state permanent residency through financial investment.

What Occurs if My Investment Fails?

If a financial investment falls short, the individual may encounter monetary loss and potential rejection of the EB5 application. It is vital to analyze dangers and consider different investments to mitigate such end results during the application procedure

Are There Age Constraints for EB5 Applicants?

There are no specific age constraints for EB5 applicants. Minors have to have a legal guardian or parent take care of the investment, while adults need to fulfill the program's lawful and financial requirements to use efficiently.

Needs Can Family Members Members Apply With Me for EB5?

Yes, member of the family can apply with an EB5 applicant. The more info program allows partners and single kids under 21 to be included in the application, offering a pathway for them to obtain irreversible residency too.

Steering with the EB5 copyright procedure provides a complex landscape for potential capitalists. The EB5 program has actually obtained appeal amongst international financiers seeking irreversible residency in the United States, recognizing its demands is vital for effective involvement. Steering via the intricacies of the EB5 copyright procedure can be daunting, making legal aid a very useful resource for prospective capitalists. While preparing for the EB5 interview, capitalists need to understand the value of this crucial step in the authorization process. If a financial investment stops working, the person may encounter monetary loss and potential rejection of the EB5 application.